INTRODUCTION

Undoubtedly, the evidence of our living conditions points to one conclusion – we are in difficult times and serious economic crisis.

Sadly, there is little hope in the initiatives that can help curb, reduce or mitigate against the rising cost of living driven predominantly by escalating fuel prices and the fast depreciation of the Ghana cedi against major trading currencies.

At an increasing inflation rate, the purchasing value of money from disposable income is eroding at an alarming rate. Incomes from investments and businesses are equally not spared – and with no prospect of a short to mid-term economic recovery.

In these unsettled times, persons with mortgage repayment obligations denominated in United States Dollars ($) deserve our fervent prayers. Today, a $500 monthly mortgage repayment commitment will have jumped from GHS2,881.55 in December 2020 to GHS3,519.25 using exchange rates quoted on the Bank of Ghana website – definitely higher at a commercial bank conversion. The indicative minimum increase of 22.1% in monthly repayments over the relatively short period is a worrying trend.

With this leap, many will not be able to honour their monthly repayment commitments. The resultant outcome of defaults (estimated to be high) provides an opportunity for the rethinkingof mortgage financing in Ghana especially when a short-term economic recovery may not be attained.

In this article, we hope the interventions discussed will provide the signposts for policymakers/regulators, financial institutions, and borrowers in designing new approaches to mortgage financing to save the subsector from collapse.

HOUSING AND MORTGAGES

Ghana’s housing deficit is observed to have reduced by 33% since the year 2000 following the 2021 Population and Housing Census; a feat the country could not have achieved without the significant contribution of mortgage financing. Although remarkably progressive, the current estimated housing deficit of 1.8 million remains high, requiring a coordinated strategy for the supply and demand management of housing provision going forward.

Government and private sector interests in providing more housing units remain high. However, financing options for the purchase and ownership of these houses remain limited. Individuals are unable to raise the required financing from personal sources as the same is beyond the means of the majority of the populace.

Therefore, mortgage financing has become the most preferred financing option for many homeowners either seeking to acquire new homes, complete or renovate existing ones or undertake equity release for other commercial or personal purposes.

A mortgage, serving as a lien or claim held by a lender on the title to a property of a borrower in exchange for a loan mostly to acquire properties, is a creature of statute. By law, an executed mortgage only operates as an encumbrance or a charge on aproperty serving as security for the repayment obligation under the mortgage agreement. In effect, a mortgage does not result in a change of ownership of the property, the subject matter of the mortgage agreement. The borrower retains the right to redeem the property both in law and equity – once a mortgage, always a mortgage, except in circumstances of defaults where the lender takes steps to repossess the mortgaged property.

Although the financing regime for loans for construction or purchase of homes or properties is also regulated, issues of pricing, tenure, etc. are matters of individual negotiations with the financing institution. By practice, the average tenure for a mortgage is 15 years and largely denominated in United States Dollars ($) on the requisite approval from the Bank of Ghana to transact in same. Equally, mortgage rates could be fixed or adjustable subject to agreed conditions.

THE BORROWER’S PRIMARY OBLIGATION

The borrower’s primary obligation is to honour without fail, the agreed repayment amount in full and on time. This obligation is fundamental to the enjoyment of rights associated with the mortgaged property as failure puts the same at risk.

Underlying this obligation are matters of interest rates, tenure, and the currency denomination of the repayment amount flowing from the denomination of the principal facility amount. A mortgage facility denominated in US dollars ($) mostly attracts an average of 13% interest rate over an average tenure of 15 years.

It is erroneous to assume that, a lower interest rate compared torates of commercial loans denominated in Ghana Cedis over a longer tenure implies a flexible repayment obligation – on conversion, such interest rates impose a higher repayment obligation than Ghana cedi denominated loans.

Honouring scheduled repayment amounts has become the major reason for defaults in repayment obligations. A mortgage facility denominated in US dollars is to be repaid in US dollars. The difficulties arise when a Ghana Cedi earner (borrower)undertakes to repay a mortgaged facility in US dollars. In effect, the borrower must raise the Ghana Cedis equivalent each month using the US dollar selling rate of the financial institution as the conversion rate.

The culminating effect of a rapidly depreciating currency (Ghana Cedis) is that, a borrower’s scheduled repayment obligation increases daily and at a fast rate. Today, a borrower is unable to forecast and plan for his or her repayments as the US dollar exchange rate has become unpredictable. A borrower only prepares to pay more on monthly basis whilst contending with the increasing economic pressures on his or her disposableincome.

At this rate, the borrower’s ability to make repayments on schedule will become strained resulting in defaults, andincreasing the stock of non-performing loans for financial institutions.

INTERVENTIONS IN TIMES OF CRISIS

With exchange rate stability or predictability, a mortgage repayment obligation denominated in US dollars ($) could with some level of certainty be honoured. In the absence of the same coupled with the economic crisis as we are currently experiencing, borrowers will require some interventions to navigate the difficult times and resume scheduled repayments once economic conditions improve. These interventions could also form the basis for an overhaul of our mortgage financing regime. The proposed intervention include:A. Mortgage loan denomination mandate by the Bank of Ghana

Financial institutions may view this call as unattractive for mortgage financing but it has the potential to provide long-term forex stability and improve the repayment obligation of borrowers. Therefore, the central bank must take steps to revoke all approvals or consents for the US dollar denomination of mortgages in Ghana. Guidelines must be developed to aid a fair and equitable conversion of existing US dollar denomination mortgages into Ghana Cedis following the revocation of approvals or consents. Further, the Bank of Ghana must mandate only Ghana Cedis denominated mortgage loans in Ghana.

These pricing initiatives have become necessary options at minimizing the immediate effects of the depreciation of the Ghana Cedis and resetting the pricing regime for mortgage financing in Ghana. B. Adoption of “Conversion rate plus Margin” financing model

Absence the political will of the Bank of Ghana to implement the first intervention, financial institutions must incorporate a “conversion rate plus margin” repayment formula into their mortgage financing denominated in US dollars. This formula may reduce the overall financial gains from a mortgage facility over its tenure but could improve the loan servicing rates than the current state of affairs.

By this formula, a loan tenure will be divided into phases and assigned a pre-agreed applicable exchange rate (as maximum ceiling) plus a margin as the conversion rate for repayment obligation denominated in US dollars during the phase. The conversion rate for the next phase is adjusted using the same formula for the previous phase.

With the right financial modeling, certainty and predictability will be restored in the conversation rate for mortgage loans over a specified phase of the tenure. This will aid borrowers in planning for their repayment obligation than it pertains to in the current circumstance of volatile exchange rate increases.

Financial institutions could pilot and fine-tune this model based on insights before mass rollouts.C. Use of conventional approaches

Mortgage loan defaults are not a new phenomenon – as no approach has entirely prevented the same. As containment strategy, restructuring negotiations and repossession processes have been used over the years to ensure resumption of repayment obligations or forfeiture of security for loans respectively.

It is prudent to continue and enhance these conventional approaches with a deep appreciation of the general economic circumstances and with a touch of humanity – although least expected when financial recoveries.

Financial institutions must set early warning thresholds and strictly take early remedies steps to engage borrowers to avoid compounding repayment obligations over months. In worse casescenarios, repossession efforts either through independent attempts or the courts must be pursued with an open mind and opportunity for the borrower to redeem his obligations under an executed mortgage agreement.

CONCLUSION

Difficult times do not warrant a waiver of obligations, especially financial ones. Therefore, we do not anticipate borrowers under mortgage agreements are expecting financial institutions to write off their repayment obligations. However, the need to provide more flexible and responsive repayment opportunities can also not be ignored in the current economic crisis we find ourselves in. It is to this end that, we are advocating for the interventions to provide immediate and long-term cushion for borrowers while improving the general loan servicing rates for the mortgage financing subsector.

About the Authors

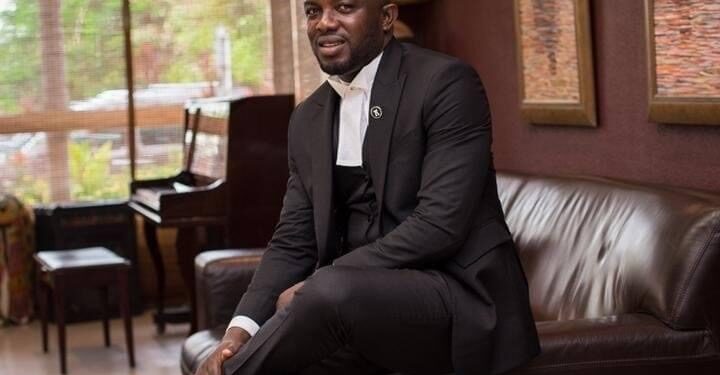

RICHARD NUNEKPEKU is the Managing Partner of SUSTINERI ATTORNEYS PRUC, a client-centric boutique law firm specialized in transactions, corporate legal services, dispute resolutions, and tax. Richard leads the firm’s Corporate and Commercial Practice with a focus on FinTech and Start-upsdevelopment. He is reachable at richard@sustineriattorneys.com

CECILIA ANTWI KYEM is a Part II student of the Ghana School of Law and interns at SUSTINERI ATTORNEYS PRUC. Cecilia has an interest in Commercial Transactions, Financial Technology (Fintech), Start-ups and SMEs, Company Law and Contracts as well as Alternative Dispute Resolution. She is reachable at kyemcecilia@gmail.com